“More of a question of retention in a buoyant market than attraction.”

With all the published uncertainty around the hiring market, it is difficult to get an overall sense of recruitment experience and priorities in HR. Our own findings and experiences with hiring patterns, as noted by our UK Managing Director, Amy Morris, differed significantly from APSCo (Association of Professional Staffing Companies) published figures. These, in turn, read differently to total numbers published on direct company websites. As such, we were keen to ask our customers for their experience of the HR hiring market, their key priorities on the HR agenda and hiring priorities moving into 2023.

Our Respondents

We asked 179 professionals in the HR & Reward space their view. 74% of our respondents work in London, 13% from the South West and Thames Valley. 6% from the Midlands and 2% from the North West of England.

35% of our responses came from those in broad commerce & industry sectors, 28% from financial services, and 23.5% from the professional services sector.

The results make for interesting reading.

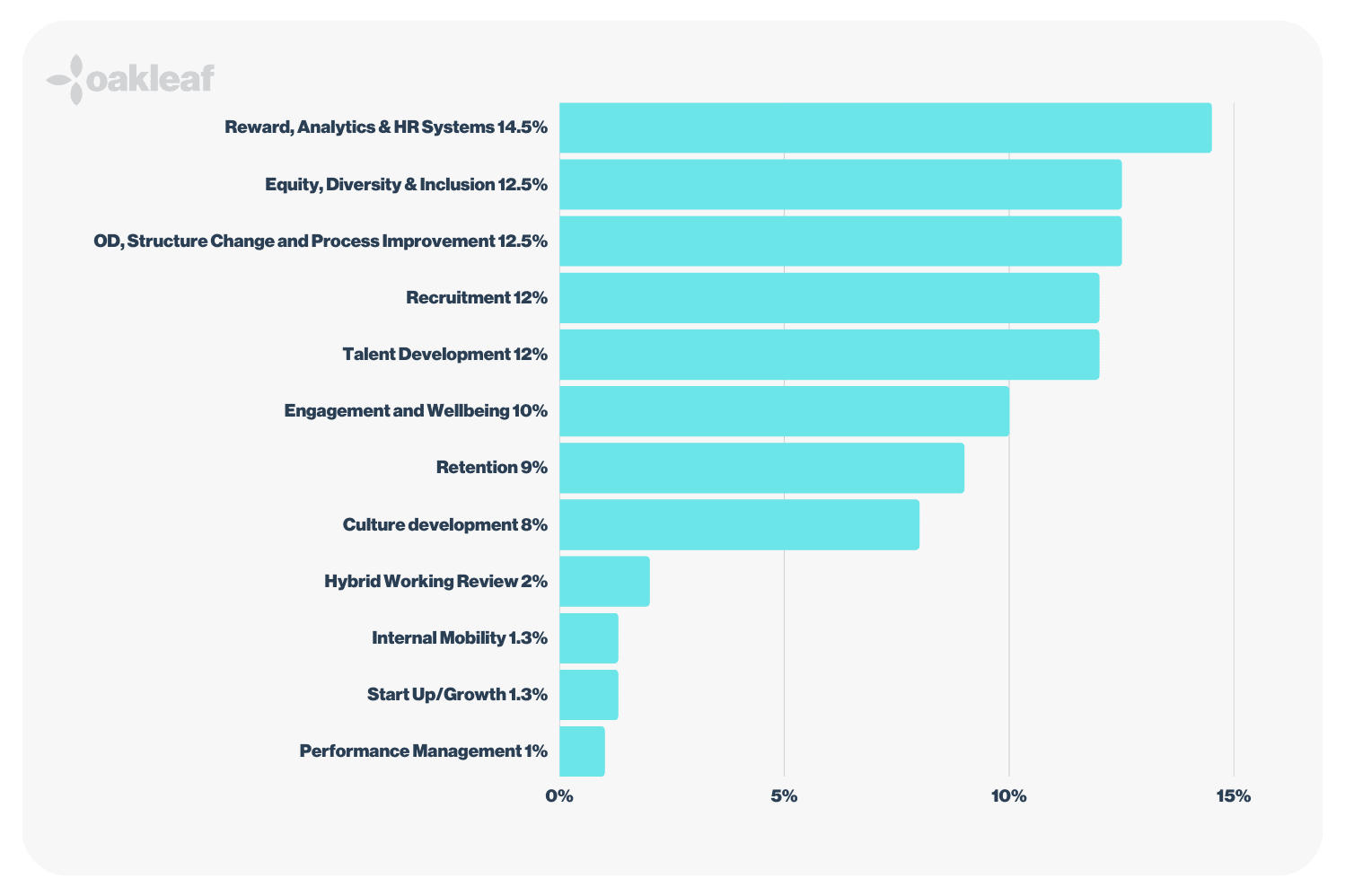

Key HR focus areas in the next six months

The drive for better quality data and metrics is at the top of the agenda for many in HR in 2023. 14.5% of all respondents indicated that reward, analytics and HR systems are the most important focus in the first half of this year. Culture, recruitment and development share equal emphasis for HR teams with focus on equity, diversity and inclusion appearing as the second highest priority.

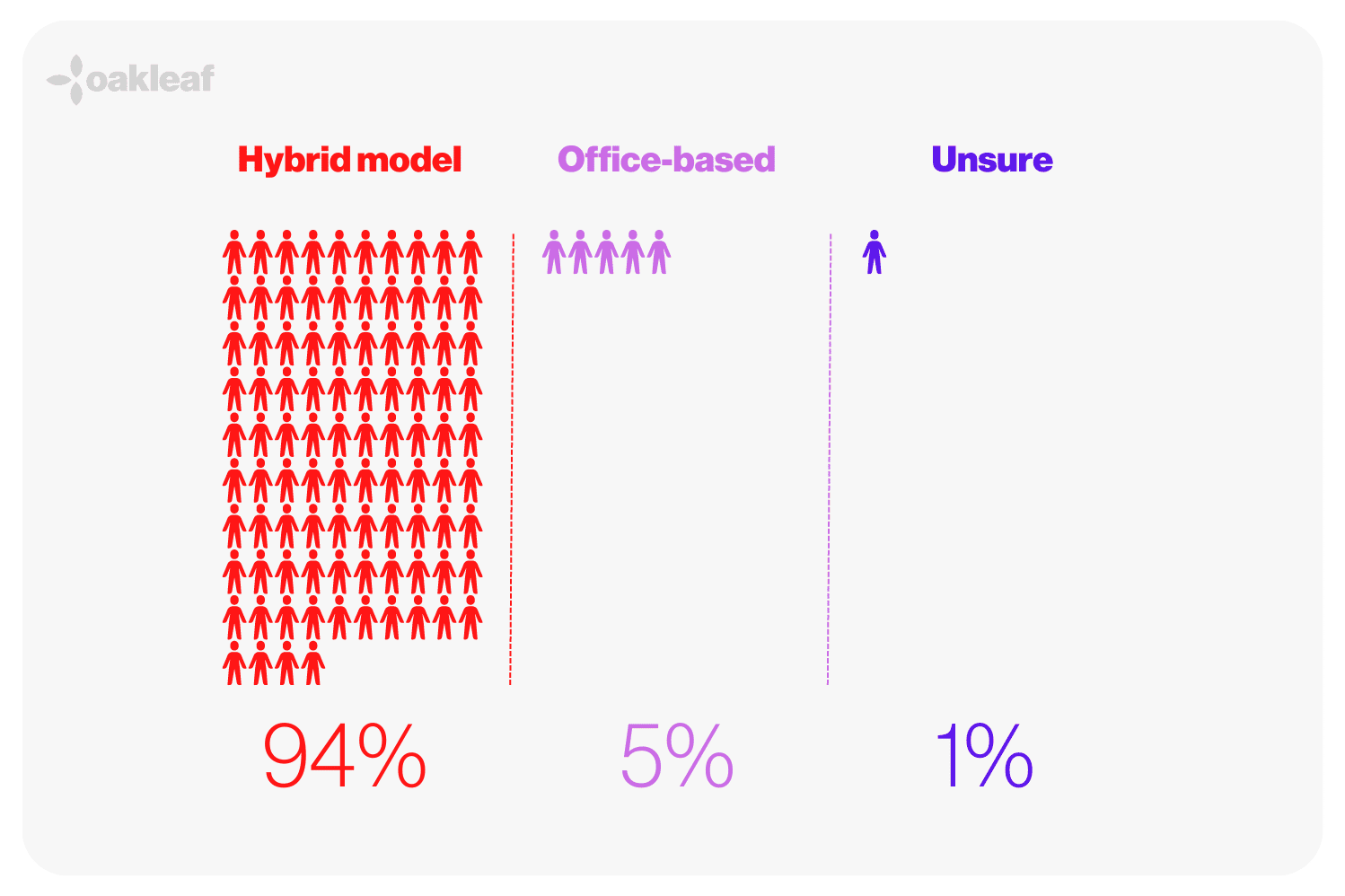

The future of work

Despite some growing recent opinion to the contrary, an overwhelming number of HR professionals, 94% of those surveyed, believe the hybrid model is here to stay. In what form remains to be seen, but returning to a purely office-based model appears highly unlikely for the vast majority.

While full-time office work does not appeal to the majority, neither does the opportunity to work fully remotely. Under one in five feel hiring fully remote-based talent is a real consideration with the new financial year approaching.

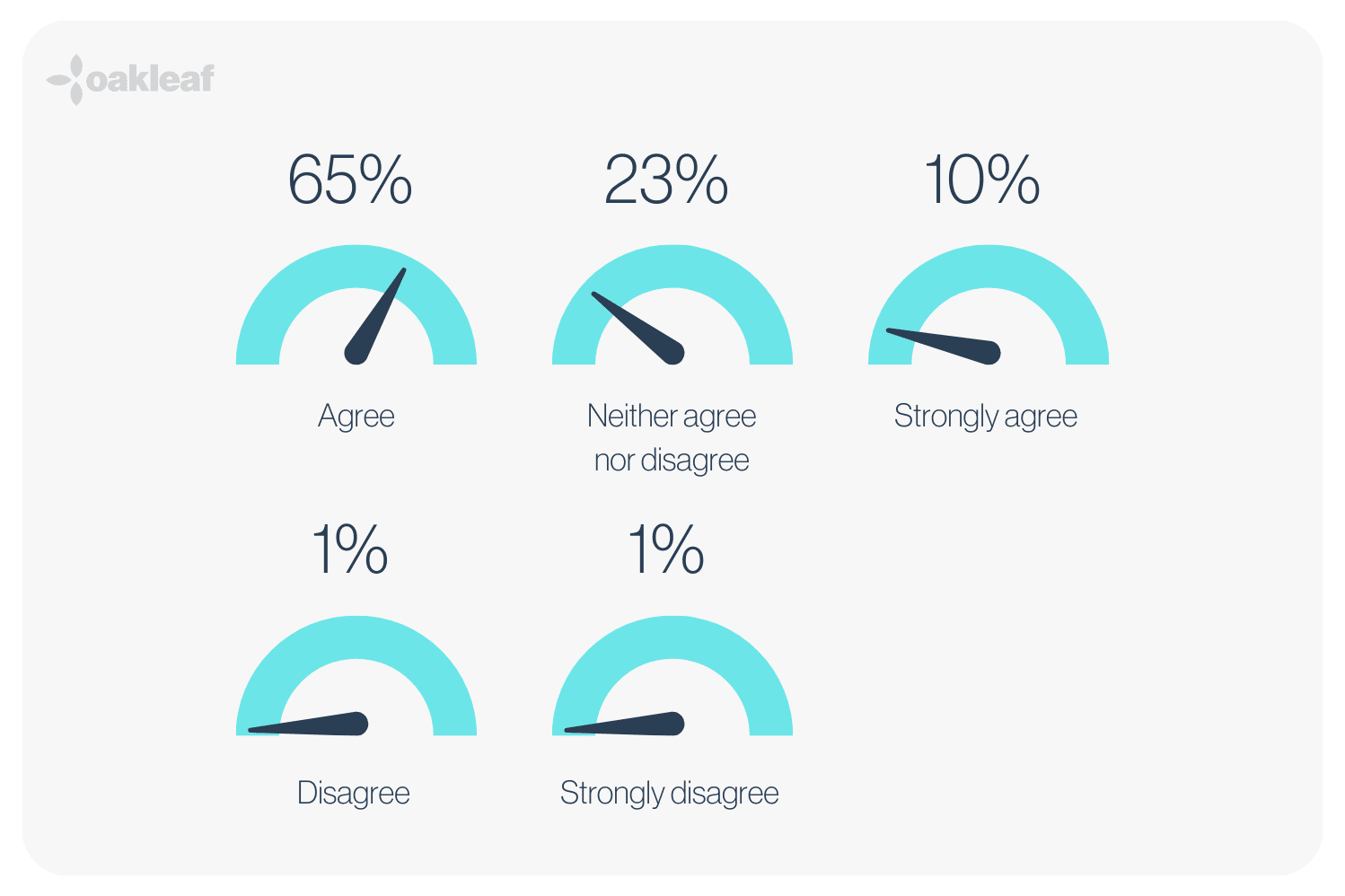

The experience of many firms trying to keep their valued employees engaged and their company culture alive through lockdown has meant a real shift in the emphasis of a strong, slick onboarding process. Three quarters of our respondents felt their organisation integrated hybrid and remote workers well, just 2% felt their company did not.

Hiring Predictions

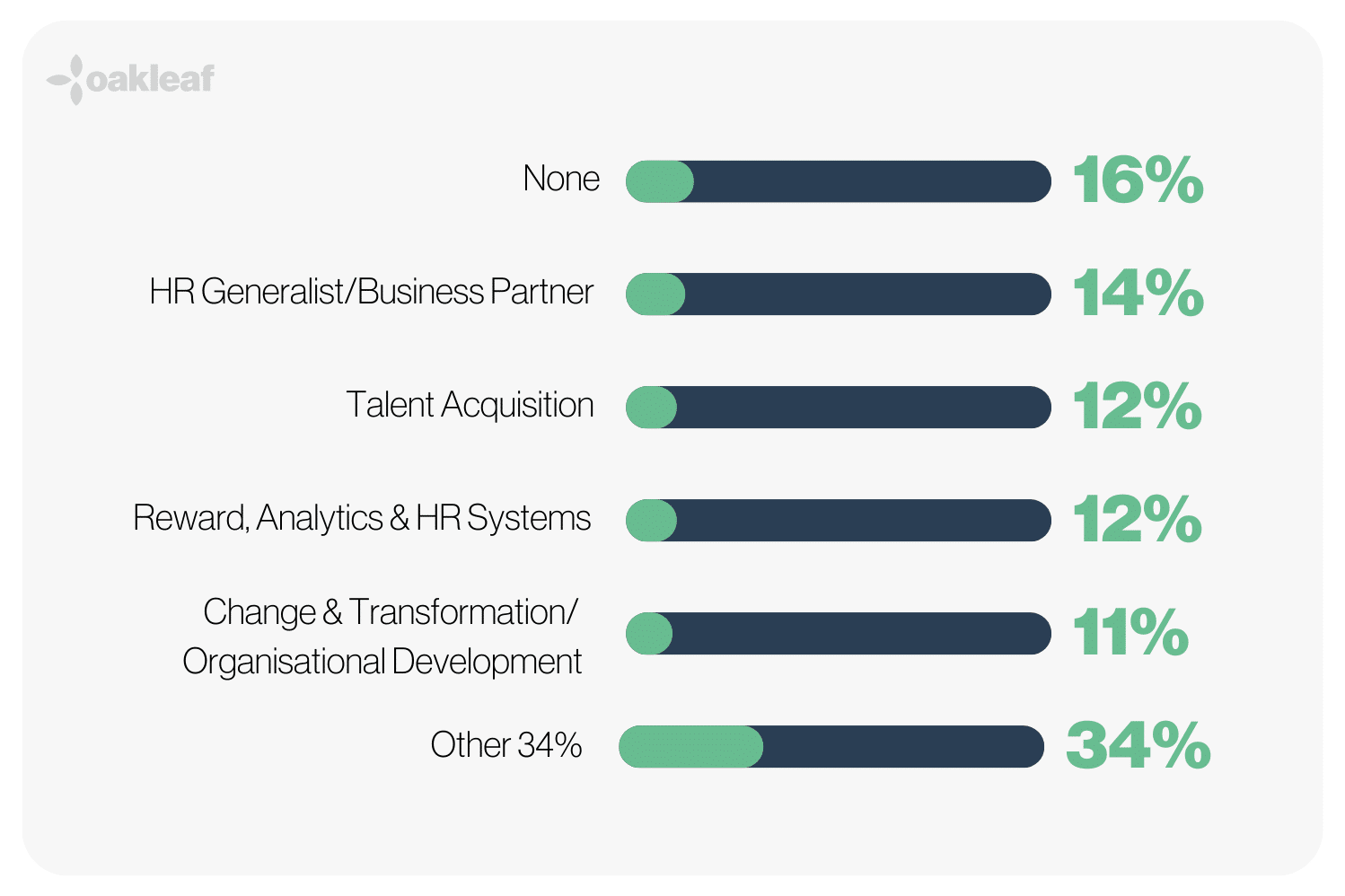

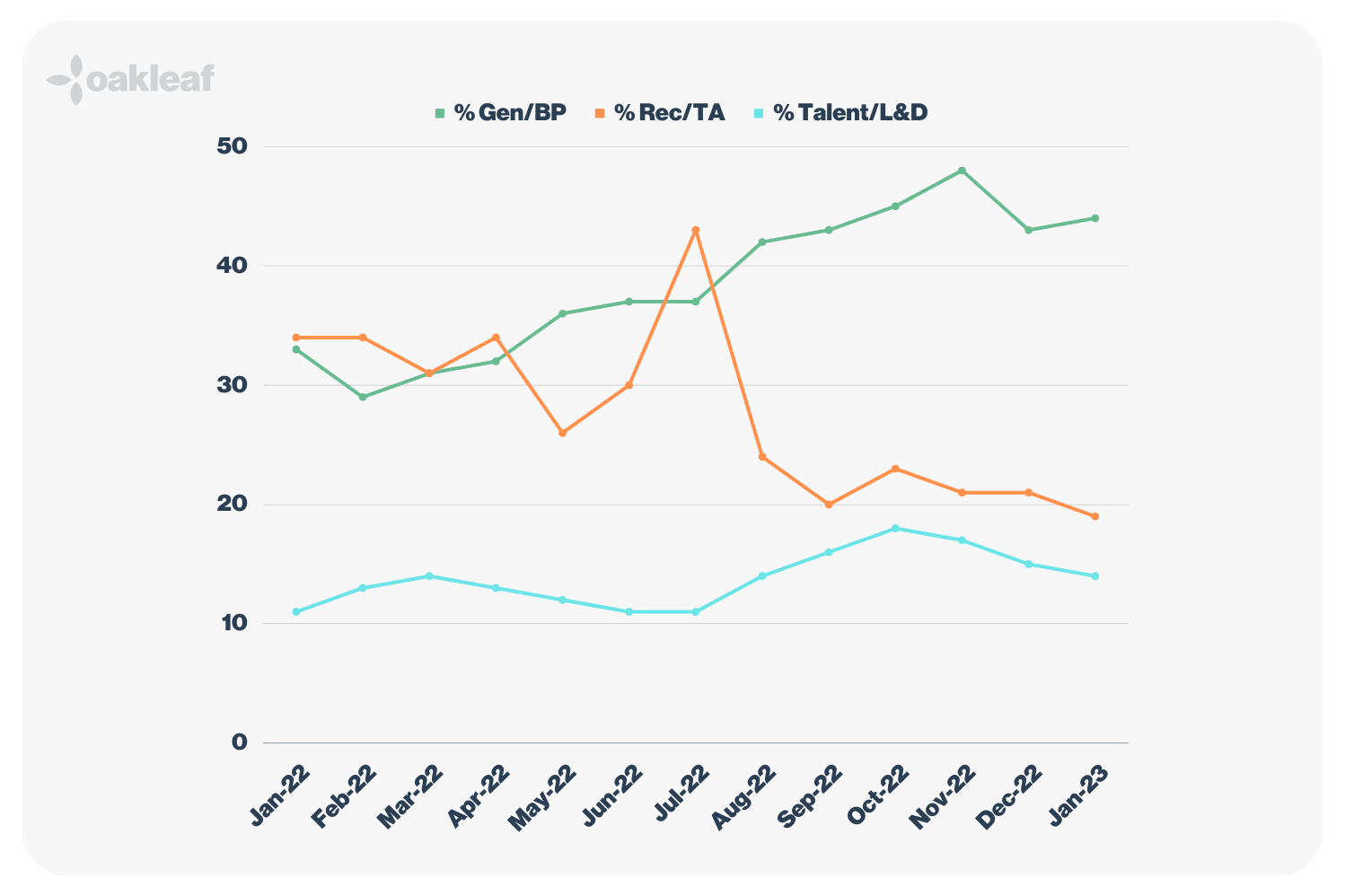

What recession? 84% of respondents anticipate additional hiring needs in the next six months, the majority of which are likely to appear across the HR Generalist/Business Partner space. Increased focus on recruitment activity and in reward, analytics and HR systems is reflected in predicted demand for talent acquisition and reward professionals.

An eventful two years that have seen a significant shift in the makeup of many organisations is evident in a perceived commitment to hire specialists in organisational development, change and transformation.

An early indicator of a challenging job market can be an increase in the ratio of hiring temporary workers to provide a stop gap solution while budgets for permanent hiring are tight. Results suggest that close to two-thirds of predicted hiring is likely to be for permanent roles, with a further quarter of responses indicating fixed-term contracts will form most of their hiring, with 14% stating their recruitment will be mostly driven by temporary/contract roles.

Oakleaf’s current HR and reward job portfolio in the UK (at time of writing), show a stronger commitment to permanent recruitment, which comprises 75% or our portfolio, with fixed-term contracts making up 15% and the remaining 10% being interim roles.

Your experience of the HR hiring market

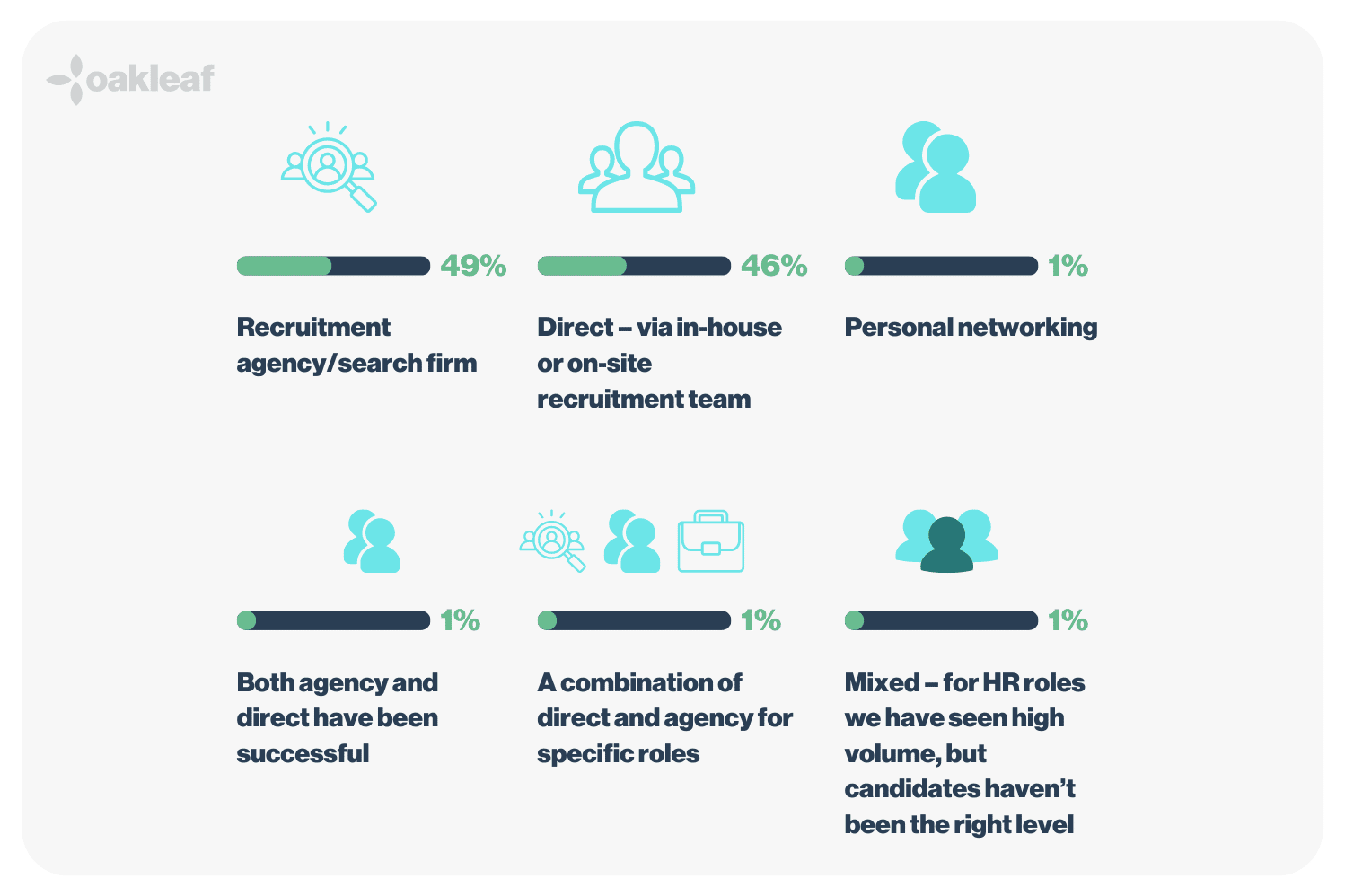

External hiring partners, namely recruitment agencies or search firms, are slightly more preferred to in-house or on-site recruitment teams as the most successful source of candidates in hiring processes. Several respondents indicate equal success with a combination of the two. In our own experience, Oakleaf’s most successful relationships with clients have been formed with clear, transparent collaboration and communication with our customers’ in-house or on-site teams, sharing information and a combined commitment to hire the best available talent.

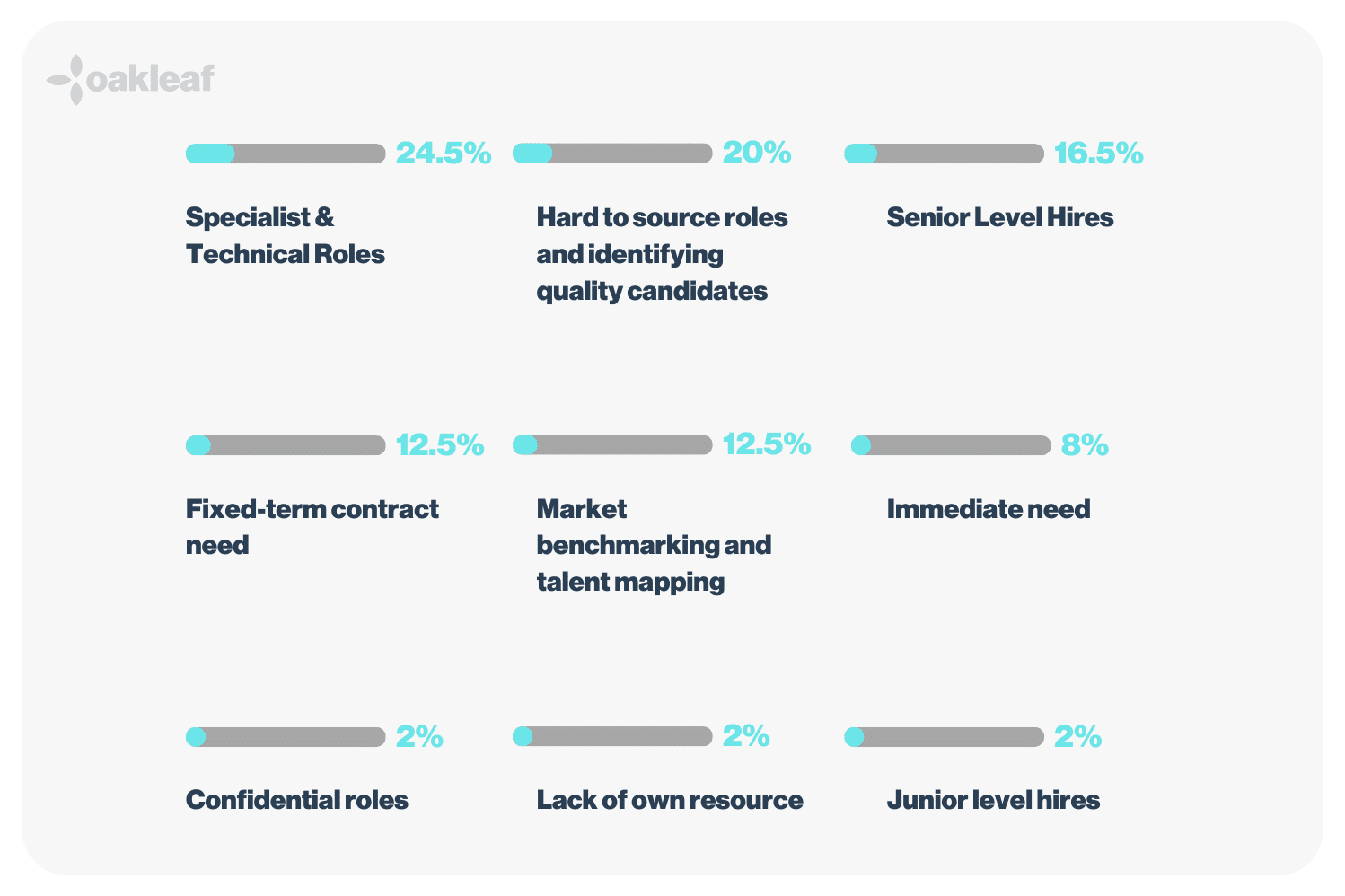

Where external partners have been most successful is in supporting hiring for specialist and technical positions, with 24.5% of respondents outlining this. Unsurprisingly, hard to source roles where strong talent was at a premium, accounted for 20% of responses with senior level hires also benefitting from specialist partnership and collaboration. Firms also benefitted from their external partners’ ability to fill an immediate or fixed-term contract need.

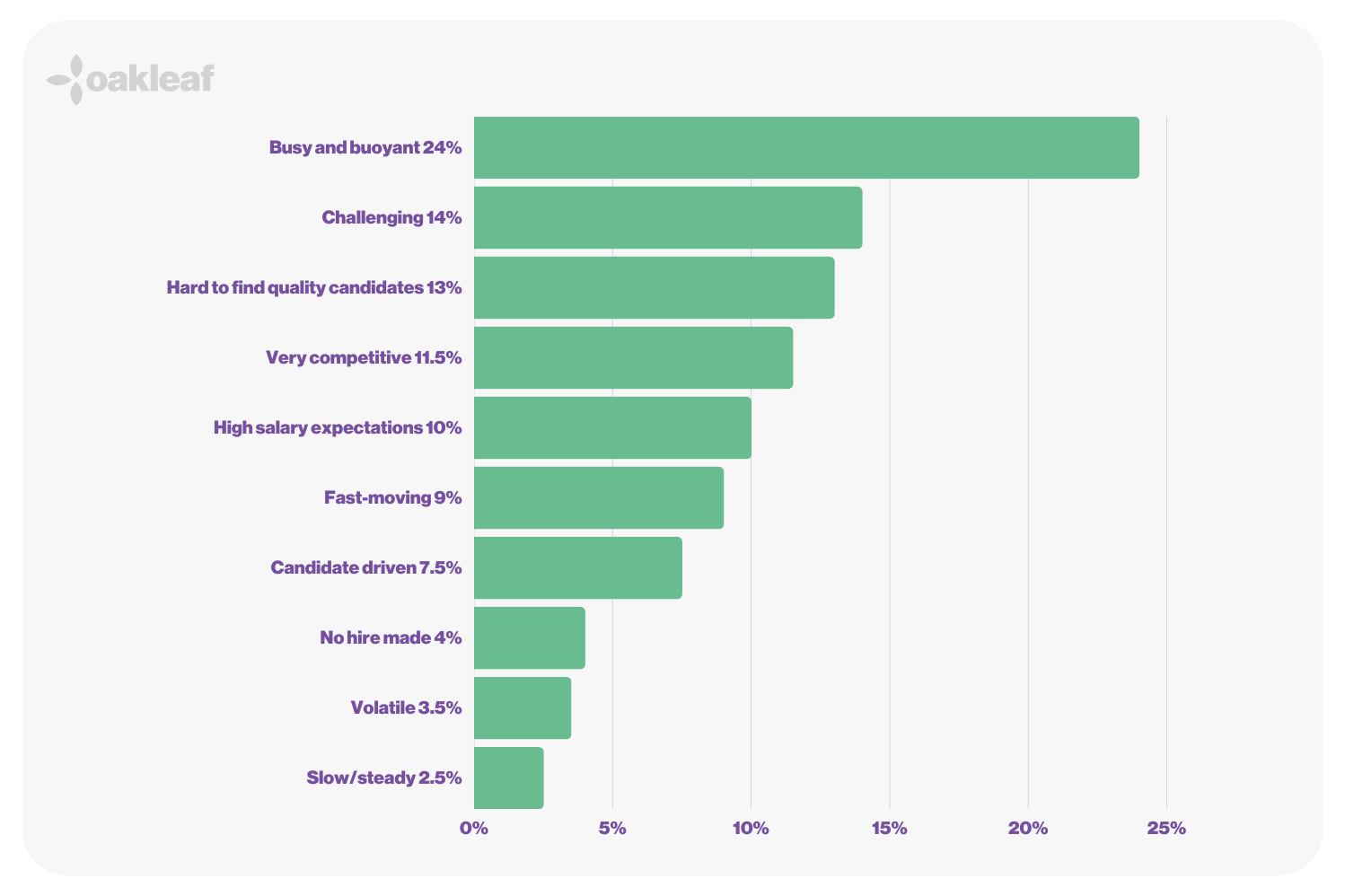

Our respondents’ experience of the hiring market has revealed some interesting commentary. One respondent summarised: “High volume, sporadic quality… expensive.” Challenging recruitment conditions have been exacerbated by a lack of quality talent which has inflated salaries over and above many firms’ recruitment budgets. “Specialist skill is limited and in demand,” wrote another.

Hiring managers have faced the stark choice of overpaying for a level of experience that threatened to upset the balance in pay for existing employees and losing their preferred candidate to remain in budget. One hiring manager concluded that the “market has been very candidate driven this year, difficult to find strong candidates with salaries pushed up compared to current incumbents.”

Another simply summed the market up as “crazy.”

Where external partners have been most successful is in supporting hiring for specialist and technical positions, with 24.5% of respondents outlining this. Unsurprisingly, hard to source roles where strong talent was at a premium, accounted for 20% of responses with senior level hires also benefitting from specialist partnership and collaboration. Firms also benefitted from their external partners’ ability to fill an immediate or fixed-term contract need.

Our respondents’ experience of the hiring market has revealed some interesting commentary. One respondent summarised: “High volume, sporadic quality… expensive.” Challenging recruitment conditions have been exacerbated by a lack of quality talent which has inflated salaries over and above many firms’ recruitment budgets. “Specialist skill is limited and in demand,” wrote another.

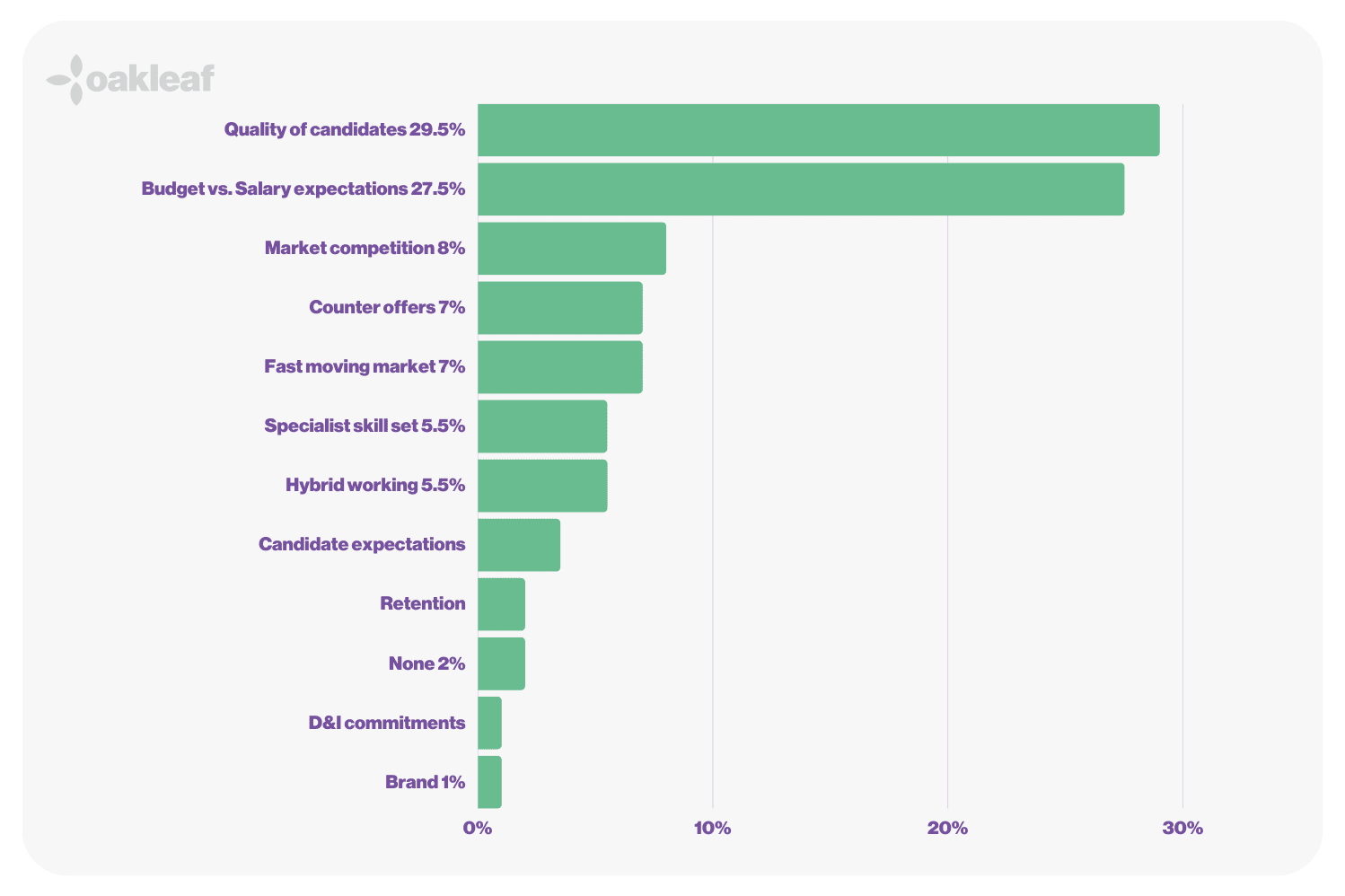

What have been the biggest challenges in hiring?

The two clearest challenges have been a lack of available quality talent and a surge in candidates’ salary expectations, meaning firms have been unable to find the right specialist with suitable experience to match their budgets. One commentator described it as “the salary war.”

The demand for HR and reward practitioners who understand their key business drivers remains high and these individuals remain hard to find. “Finding candidates with a commercial outlook (rather than process driven) within a reasonable budget” was a challenge for one hiring manager.

Several participants commented on the pace of the market in addition to growing salary expectations. “The best candidates seem to have multiple offers or are counteroffered. Also, the overall lack of candidates in general,” wrote one. Another highlighted the challenge of: “the speed that things are moving, and the ridiculous salaries being requested.”

Retention

In a competitive recruitment market, staff retention becomes equally challenging. One contributor mentioned the difficulty in “retaining a team being headhunted constantly,” while another added that it was “more of a question of retention in a buoyant market than attraction.”

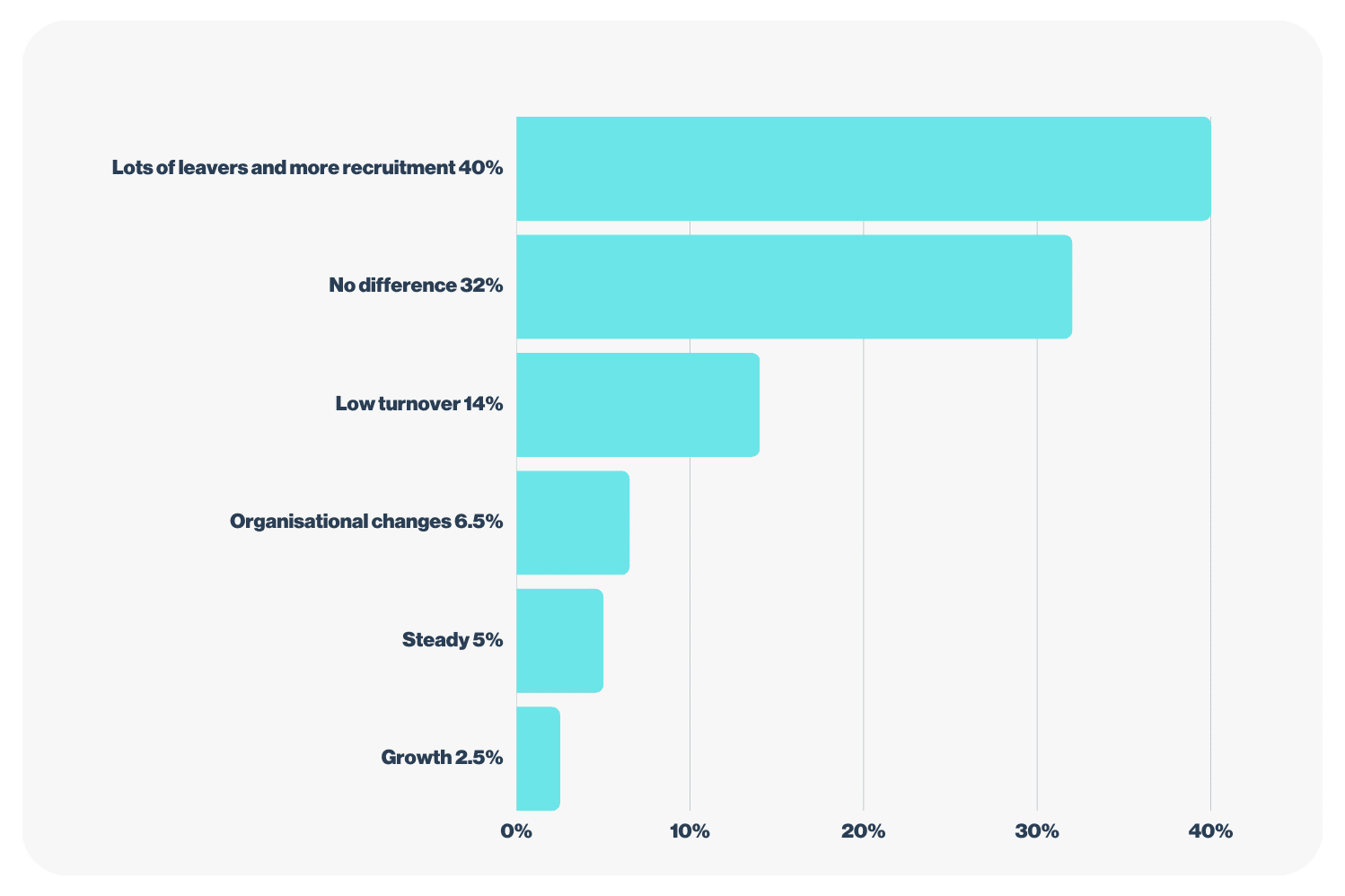

40% of those surveyed said their firm had lots of leavers and therefore had more recruitment needs. “People leaving for salaries we can’t compete with,” commented one individual, while another added: “Due to the demands of the business, the HR team have been impacted massively and have a large volume of work. In turn, we have had resignations.” Several commentators noted that there had been “a lot of turnover in the HR team due to incredibly high workload and burn out.”

The Great Resignation? Not necessarily. A lot of firms saw the opportunity to restructure and reorganise. One individual observed: “Organisation wide strategy/transformation has dictated turnover more than hybrid working.”

Oakleaf noted a significant increase in demand for recruiters in various spells last year, during July, September, and November in particular. Research into direct company hiring trends showed 43% of all HR vacancies sat in Talent Acquisition in July. Numerous firms saw growth in their recruitment teams. “We’ve grown dramatically, especially in Talent Acquisition with three or four new hires” added one, while another commented: “We have increased the size of our recruitment team and also bolstered our benefits and global mobility teams.” One firm mentioned “4 extra headcount added now to help.”

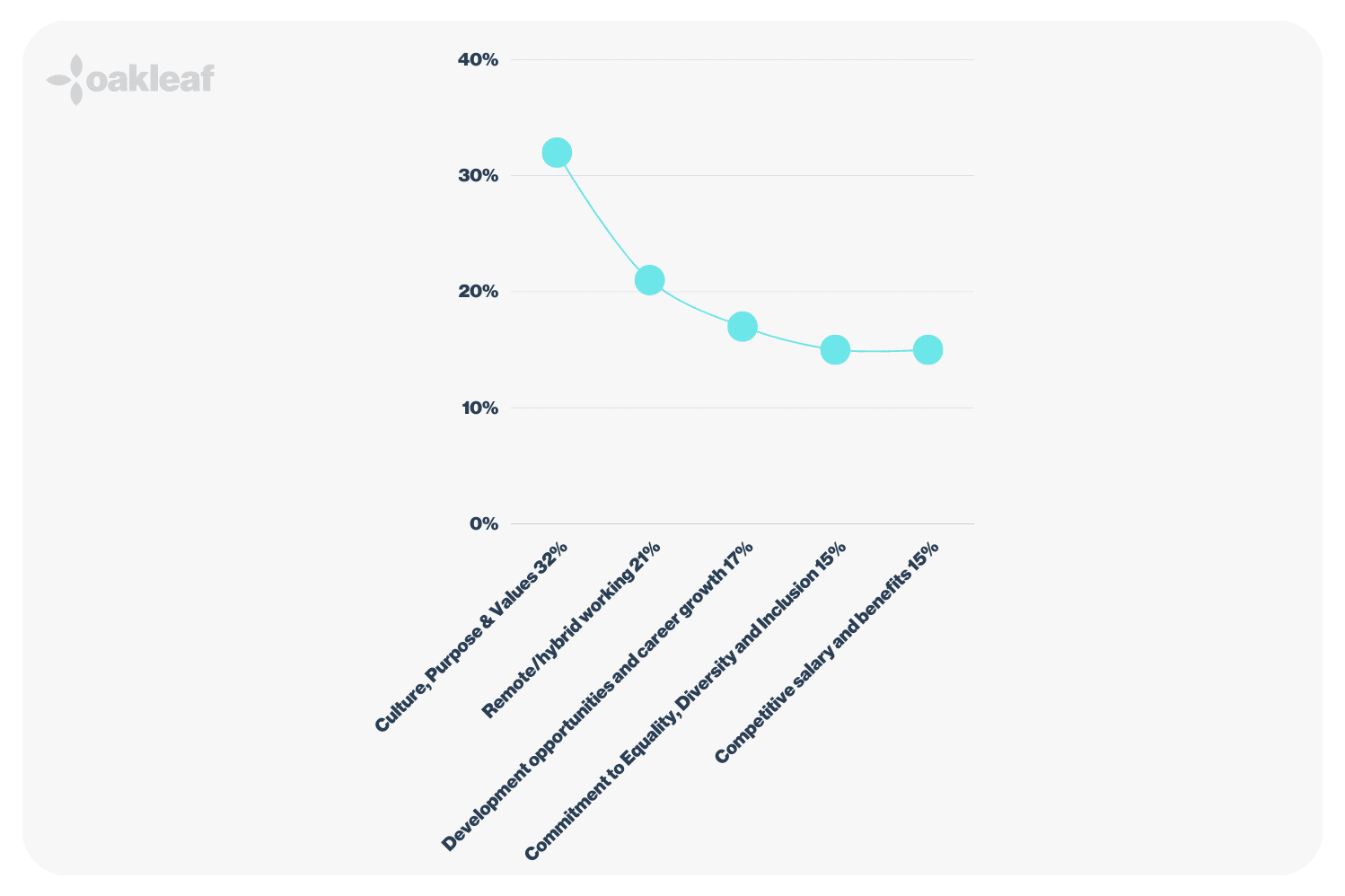

What are the strongest pull factors?

Despite a significant amount of feedback outlining salary expectations as a major challenge in hiring, just 15% of HR professionals responded that this is one of the strongest “pull” factors in attracting new talent. Culture, the offer of hybrid/remote working, career growth and development were all seen as more attractive considerations to recruit candidates, with a firm’s commitment to diversity and inclusion considered an equal factor to salary and benefits. One commentator wrote: “Our company is very business and commercially focused which has not allowed us to work on our culture for some time.”

The challenge of recapturing company culture has been sizeable. Striking the right balance in a hybrid model appears to have been the biggest challenge. Participants wrote of “different existing subcultures and challenging to build one culture with people in different locations.” Retaining their culture amid rapid expansion with increased hiring and the increased workload and pressure on HR teams also appears to have been significant. One contributor talked about the impact on “morale and engagement – fatigue from external and economic climate.”

Some firms, however, do not seem to have had the same issues. One HR professional said their firm was “not overly challenged as we had adopted the hybrid working model pre Covid. We also have away days to bring us together as a team.” Another firm talked about “lack of cross over with the whole team but implemented anchor days.”

Ten years ago, we surveyed senior HR leaders on their view of the market and a key theme emerged was that “change is the new norm.” If there is any certainty about the current market, paradoxically, it is its uncertainty. The ability for businesses to move and adapt at pace to changing conditions is critical, as is, from these responses, the importance of a strong culture in attracting, retaining and empowering their HR talent.

It will be fascinating to see how this year unfolds.